What is a Business License?

As a seller, you may be asking “do I need a business license to sell online?” First of all, let’s define what is a business license. It’s a legal document allowing you the right to run a business in your city or county. It can serve as evidence that you are indeed operating a business, not just involved in hobby activities. This is important if you make regular sales and incur expenses you want to deduct from your business income.

Most cities and counties require you to have a business license to start selling products. But as you probably know, there are many folks working from home, selling products online who never bother to get a license.

For most enterprises, a city or county license will be enough. However, if you are in industries with products like alcohol, firearms, mining and drilling, you will need specific additional federal licenses for those types of businesses. See the list of industries requiring federal permits at: https://www.sba.gov/business-guide/launch-your-business/apply-licenses-permits

This article provides FAQ answers to questions you need to help avoid future legal hassles. As a legal business, you can take advantage of tax deductions, whether you need a business license in Alaska or a business license in Tennessee.

You will learn:

- What is a business license

- Do you need a business license to sell online

- Do I need a business license to sell crafts

- Do you need a business license to sell on Etsy

- Do you need a business license to sell on Amazon

- How much is a business license (cost)

- Requirements for a business license

- How do I get a business license

- Business license types

- What is a sales tax permit

- How long does it take to get a business license

- What does a business license look like

- How to renew a business license

- Seller’s permit vs business license

- Business license vs LLC

Do I Need a Business License to Sell Online?

Most ecommerce platforms don’t require sellers to provide a business license to sell their items online. You can start selling on Etsy, Amazon, Ebay, etc. right away without any licenses or permits, at least as far as their site requirements.

But, if you are making sales regularly, you will want a business license. It allows you to (1) document to the IRS that you are a business, not a hobby, (2) which allows you to deduct expenses incurred in running your business.

The IRS is a federal agency that collects tax on your business income. You’ll want to document you are a business and not a hobby, whether you are in California and need a business license for Los Angeles or live in Philadelphia and need a business license in Pennsylvania.

For most small business owners, the answer to “do I need a business license to sell online” is yes. Problems can arise when you have sources of income appearing in your checking account that you don’t report to the IRS. You really don’t want the IRS auditing your returns. It’s a time-consuming process that can cost you plenty.

You can establish your legitimate business activity by having a business license and a business checking account. Most banks will require a copy of your business license before opening a business checking account. But once you have both, you are on record as being in business.

Do I Need a Business License to Sell Crafts

Do I need a business license to sell online from sites that sell crafts? The license can help provide evidence you are a real business, not just engaged in a hobby. If you are regularly selling products and making an income from those sales, you should report that income and all the associated tax deductions when filing your tax returns.

Having a legal small business selling crafts provides a way to deduct expenses like travel to a craft show, to visit consignment stores where your products are for sale, and internet expenses involved in selling online.

Do You Need a Business License to Sell on Etsy

As of the time this article was published, Etsy doesn’t require a business license to open an Etsy store and sell items. That doesn’t mean you shouldn’t get a license for all the other reasons pointed to in this article. For tips on selling on Etsy, read https://craftmarketer.com/the-biggest-things-to-do-to-be-successful-with-an-etsy-store/

Do You Need a Business License to Sell on Amazon

Do I need a business license to sell online on Amazon? Like with Etsy (and other ecommerce sites like Ebay) Amazon Handmade doesn’t require a business license to and sell items on their platform. Again, that doesn’t mean you shouldn’t get a license for all the other reasons pointed to in this article.

How Much is a Business License (Cost)

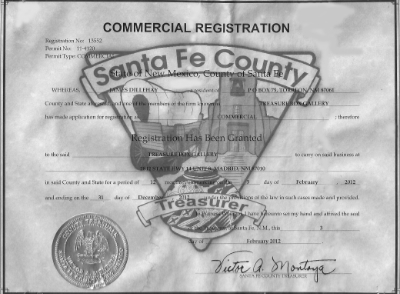

The cost of a business license varies from city to city and county to county. In my state of New Mexico, when I opened my gallery in Santa Fe County, I paid $500 for the initial license and application and then $40 a year to renew. Your city or county business license fees will vary. But the average cost of a business license is around $50 a year, with possibly a few hundred dollars for the initial application. The cost of a business license in Georgia differs from the cost a business license in Texas.

Requirements for a Business License

When you go to apply for your business license, you will most likely be required to show proof of your identity and a state sales tax permit. In most cases, you get a state sales tax permit first before applying for the business license. See below for “What is a sales tax permit.”

How Do I Get a Business License

Getting a business license is fairly easy. Your city or county taxation and revenue department issues licenses. The application process differs if you apply for a business license in California or for a business license in Washington state. Find a link to your state’s business licensing info at: https://www.sba.gov/business-guide/launch-your-business/apply-licenses-permits

Business License Types

- Zoning permit waiver. Most side gigs or small startups will be run from home, which is more than likely in a residential area. Your home probably isn’t zoned for doing business. However, you may still be allowed to operate with a zoning waiver as long as your home business activity doesn’t draw attention or get complaints from neighbors. Visit your city or county zoning office to learn their requirements.

- Local business license. Apply at your local county business registration office. See the link above for locating your local office.

- State sales tax permit. See below.

- If you sell food products, there’s yet another set of food handling regulations to meet, but each state has it’s own procedures for licensing. If you are starting out in the handmade food products business, do a search for your city followed by the words “food product business incubator.” When I was looking into selling handmade food items, I found a local agency that offered an already licensed kitchen with appropriate permits. They also provided counseling for getting started the right way in the food products business.

What is a Sales Tax Permit

State sales tax permits (sometimes called a seller’s permit): in the US, except for Alaska, Delaware, Montana, New Hampshire and Oregon, all states require a state sales tax permit for selling products or services in the respective area. To learn where to get a sales tax permit in your state, do an online search for “(your state name) sales tax permit.”

Usually the state sales tax permit is free. Once you are signed up, the state will send you forms to fill out and return with any sales tax collected. If you will sell at festivals and art and craft shows, most events require a state sales tax permit.

To clarify a business license vs a sellers permit is: if you are starting a business in Las Vegas, you need a Clark County business license locally, but you would also need a Nevada sales tax permit from the state.

For selling crafts and other handmade products online, ecommerce platforms like Etsy, Amazon, and Ebay don’t require you to provide a sales tax permit. More and more, you see these platforms collecting sales tax on sales you make. The ecommerce platform does the collecting and turning the sales tax over to the appropriate state taxation and revenue department.

If you travel out of state to do craft shows, you will need a sales tax permit for each state you sell in. For example, I do shows in Texas, New Mexico and Arizona and have permits for each state. And even if I have zero sales, I still have to file a report. But each state has its own filing requirements so don’t make the mistake of thinking reports are all due at the same time. I got fined $60 for being late with one state’s returns.

How Long Does it Take to Get a Business License

Depending on how busy your county or city is, getting a business license may take a few weeks. Often, you’ll receive a temporary license at the time you make your application. An application for a business license in South Carolina may get approved faster than a business license for Arizona because there are more applications in Arizona.

What Does a Business License Look Like

Below is an image of a business license in the City of Santa Fe, New Mexico. Your local license will probably look different.

How to Renew a Business License

Renewing your business license, is simple. Most licenses are annual, so you’ll get a renewal notice by mail near the time to renew your business license. As mentioned earlier, depending on where your business is located, the renewal fee will average around $50 but you won’t have to pay the same initial application fee of several hundred dollars. Depending on your location, you may be able to renew your business license online.

Seller’s Permit vs Business License

Seller’s permit is another phrase for state sales tax permit. It’s a different document from your business license. See “What is a sales tax permit” above.

Business License vs LLC

An LLC is a form of business, not a permit. Most home businesses operate as sole proprietorships, but even if you go the extra step to become an LLC, you would register your business license in the legal name of your LLC.

So What’s the Final Answer to Do I Need a Business License to Sell Online?

No licenses or permits or required by most ecommerce platforms like Etsy, Amazon, Ebay, etc.

But your local and state government require a business license and state sales tax permit. You will want these to document that you are a real business and in order to open a business checking account.

The above is probably more than you wanted to know about getting a business license. It’s one of those necessary evils that, once taken care of, you are free to focus on what you want to do more of — making and selling your handmade items.